Year: 2011

04 May 2011

Chinese social networking site Renren is hoping to replicate the blowout success of another Chinese internet company, Qihoo 360 Technology, which sold US$176 million worth of shares in March on Nasdaq, the US technology stock market. read

China, Corporate governance, Due diligence, NYSE, US

China, Corporate governance, Due diligence... +2 more

04 May 2011

HONG KONG (Dow Jones Investment Banker) – The long-awaited international board of the Shanghai Stock Exchange (SSE) apparently is inching closer to becoming a reality. But its offerings are likely to be dominated by Chinese companies incorporated offshore, and, if history is any guide, listing there is likely to do little in the long run for truly international businesses.

read

China, Hong Kong, Secondary listings, Yuan securities

China, Hong Kong, Secondary listings... +1 more

04 May 2011

“IPO: A Global Guide” featured on 2 May 2011 in the “Inner Circle of Finance” weekly column written by hedge fund manager C.K. Edward Chin. An extract of the column mentioning the book, which also included a picture of its front cover, is set out below. read

Hong Kong, Interviews

Hong Kong, Interviews

02 May 2011

HONG KONG (Dow Jones Investment Banker) – Mongolia’s top 20 index is up more than 50% in local terms this year, but trading volumes remain diminutive. This could all change with the proposed listing of coal mining behemoth Erdenes Tavan Tolgoi (Erdenes TT), whose name means “five heads” in Mongolian. While lead banks have been appointed, their exact roles are said to remain fluid, and a gaggle of global houses is still competing to find its way into the offering, which will raise Mongolia’s profile on the international stage. Indeed, the fortunes of Mongolian IPOs will continue to rely heavily on international institutional investors.

read

Hong Kong, Mongolia, Privatization, Secondary listings, UK

Hong Kong, Mongolia, Privatization... +2 more

28 April 2011

“IPO: A Global Guide” featured in this week’s edition of EuroWeek magazine, in the “Big Picture” column written by Equity Editor Nick Jacob. The article is reproduced below. read

Hong Kong, Interviews, UK

Hong Kong, Interviews, UK

27 April 2011

HONG KONG (Dow Jones Investment Banker) – The first-ever yuan-denominated IPO in Hong Kong – for Hui Xian REIT – priced Tuesday, after having received a rather subdued reception from the public. Reasons include a rather aggressive yield, the offer structure for the transaction and controlling shareholder Li Ka-shing’s reputation for leaving little on the table when pricing deals, as well as uncertainties about aftermarket trading and macro market developments.

read

China, Hong Kong, REITs, Yuan securities

China, Hong Kong, REITs... +1 more

25 April 2011

HONG KONG (Dow Jones Investment Banker) – Russian President Dmitry Medvedev and his entourage were all smiles when they visited the Stock Exchange of Hong Kong’s trading hall Sunday. But listing Russian companies in Hong Kong still faces technical and regulatory hurdles, as well as in many cases an uphill struggle to convince investors in Asia that Russian stocks have a place in their portfolios.

read

Hong Kong, Russia, Secondary listings

Hong Kong, Russia, Secondary listings

20 April 2011

HONG KONG (Dow Jones Investment Banker) – Fitness First is likely to apply to Singapore’s SGX this month for an eligibility-to-list letter for an IPO, with a launch this July. The business, which has been listed before in the UK, has a wide footprint and boasts impressive statistics, as well as a clear ability to generate cash (2009 EBITDAwas US$238 million equivalent). We look at the group, and at the possible shape the IPO might take.

read

Pro forma accounts, Singapore, UK

Pro forma accounts, Singapore, UK

18 April 2011

“IPO: A Global Guide” featured in today’s edition of the Hong Kong Economic Journal, the leading Chinese language business newspaper.

read

Hong Kong, Interviews

Hong Kong, Interviews

16 April 2011

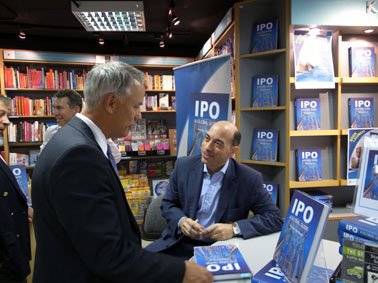

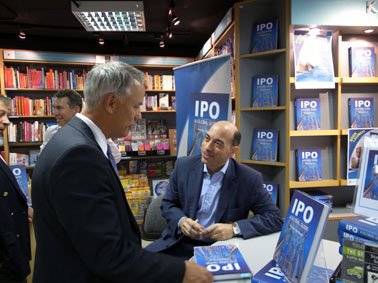

“IPO: A Global Guide” was formally launched on 15 April 2011 at Kelly & Walsh in Exchange Square in Hong Kong. The event was well attended, and saw the author signing a number of copies of the book. The attendees came from a variety of backgrounds and included, among others, ECM bankers, research analysts, traders, company directors, lawyers, investors, students and journalists.

read

Events, Hong Kong

Events, Hong Kong