Reuters Television interview

The following interview was aired today at 10:00am Hong Kong time on Reuters Television, as part of a news package on the proposed Shanghai International Board. read

The following interview was aired today at 10:00am Hong Kong time on Reuters Television, as part of a news package on the proposed Shanghai International Board. read

HONG KONG (Dow Jones Investment Banker) – Naming and shaming hasn’t worked to prevent fraud by Chinese companies going public. After a string of cases on Mainland exchanges and internationally, where companies also reported sharply lower earnings within weeks of their IPOs, the China Securities Regulatory Commission (CSRC) is putting a new onus on lead underwriters to weed out less scrupulous sponsors and restore confidence in the markets. It’s a welcome move, albeit a little late.

HONG KONG (Dow Jones Investment Banker) – MGM China Holdings Ltd. is looking to raise US$1 billion to US$1.5 billion in a Hong Kong IPO, set to price May 27. Gains in market share, as well as a buoyant market for gaming stocks, should support the flotation, provided it’s priced sensibly. That said, the deal has seen its fair share of controversy, and MGM China has to battle larger and more established players in the former Portuguese colony.

It took five months for this website to attain 10,000 page views, but only 45 days for that number to double. IPO-book.com has now been accessed by readers from 73 countries and 425 cities around the world. More than 40% of you are repeat visitors too. read

US handbags and accessories house Coach Inc. is the latest in a long list of fashion and consumer groups to seek a listing in Hong Kong. As structured, however, the proposed transaction is likely to do little beyond generating press coverage for the brand, but perhaps that’s what it’s aimed at? read

HONG KONG (Dow Jones Investment Banker) – Luxury second-hand handbag retailer Milan Station Holdings Ltd. is eyeing an IPO of up to US$35 million, for about 25% of the company in Hong Kong, according to a filing with the Stock Exchange of Hong Kong May 3. The transaction raises questions about the company’s supply arrangements, and the sustainability of its business model.

HONG KONG (Dow Jones Investment Banker) – It would be a landmark: Chinese brokerage CITIC Securities Co. Ltd. has reportedly appointed Bank of China Ltd’s Bank of China International (BOCI), China Construction Bank (CCB) International and Industrial and Commercial Bank of China (ICBC) to lead its forthcoming share offering and listing in Hong Kong, said to be around US$2.5 billion.

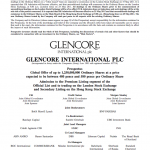

The total number of shares subscribed for by cornerstone investors in Glencore’s IPO, which is targeting proceeds of about US$10 billion (excluding a 10% over-allotment option), is expected to represent approximately 31% of the global offer, assuming the overallotment option is not exercised. The US$3.1 billion tranche therefore represents one of the largest cornerstone books by value ever achieved for an IPO. But there are consequences to the practice, which could come back and haunt the issuer as well as other investors in the company. read

I was interviewed on 9 May 2011 on Hong Kong’s RTHK 3 radio in the “Hong Kong Today” early morning show by business news presenter Nick Beacroft, on the subject of the proposed international board of the Shanghai Stock Stock Exchange. read

HONG KONG (Dow Jones Investment Banker) – PCCW Ltd.’s hope of spinning off its telecommunications business into Hong Kong’s first listed business trust were shattered when the Stock Exchange of Hong Kong’s listing committee rejected the application. The decision, revealed last week by PCCW, reinforces the SGX’s lock on this type of security, and the temptation for Hong Kong to lure this class of listing away from Singapore must have been intense. But PCCW’s plan raised troubling corporate governance issues.