Hong Kong Exchanges and Clearing Limited (HKEx) released earlier this week the findings from its Cash Market Transaction Survey for 2011/12, revealing the diversity among investors in its securities market.

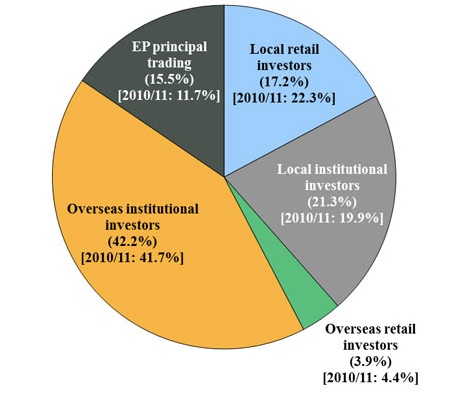

In 2011/12, overseas investors contributed 46% of total market turnover value, similar to the level achieved in 2010/11. Local investors contributed 38%, down from 42% in 2010/11. Institutional investors contributed 63% of total market turnover value (62% in 2010/11). The contribution from retail investors – both local and international – was 21% in 2011/12, down from 27% in 2010/11.

Key findings of the 2011/12 survey:

- Overseas institutional investors, the largest contributors among all investor types, contributed 42% of total market turnover, similar to their contribution in 2010/11.

- Local institutional investors contributed 21% to total market turnover, compared to 20% in 2010/11.

- Local retail investors contributed 17% to total market turnover, down from 22% in 2010/11.

- Exchange Participants’ principal trading contributed a record high of 15% of total market turnover in 2011/12, up from 12% in 2010/11.

Findings regarding trading value by overseas investors showed that:

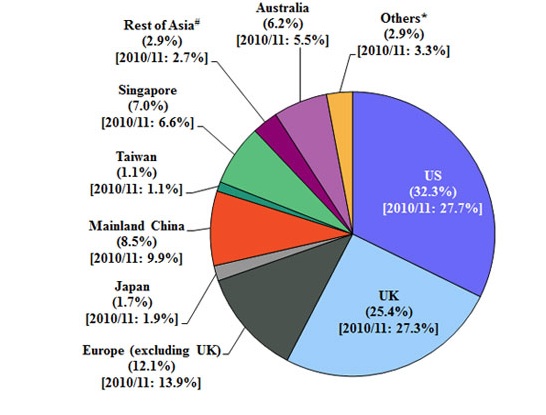

- US investors were the largest contributors to overseas investor trading in 2011/12 with a contribution of 32%, up from 28% in 2010/11.

- UK investors, the second largest contributors, contributed 25% of overseas investor trading in 2011/12, down from 27% in 2010/11.

- Continental European investors were ranked third with a contribution to overseas investor trading of 12% in 2011/12, down from 14% in 2010/11.

- The contribution of investors from mainland China to overseas investor trading was 8% in 2011/12, down from 10% in 2010/11.

- Asian investors in aggregate contributed 21% of overseas investor trading in 2011/12, compared to 22% in 2010/11.

- There were 16 reported origins of overseas investors in Asia and over 35 reported origins of overseas investors outside Asia, Europe and the US.

Over the past decade, trading from US investors had the highest compound annual growth rate (CAGR), 32%. Trading from mainland China investors had a CAGR of 28%. Both were higher than the 26% CAGR of overall overseas investor trading.

Retail online trading accounted for 34% of total retail investor trading (up from 26% in 2010/11) and 7% of total market turnover (similar to that in 2010/11).

The Cash Market Transaction Survey has been conducted annually since 1991. Each year’s survey covers HKEx’s securities market turnover for the 12-month period from October the previous year to September the following year.