HONG KONG (Dow Jones Investment Banker) – With market volatility comes caution, and IPO syndicates are no exception. Internationally and in Asia, these are increasingly becoming crowded at the senior end for sizeable transactions in particular. Junior underwriters, whose contribution remains marginal, are being squeezed out.

In the U.S. equity syndication has the merit of simplicity. IPO fees are much higher than in other countries – often 6% to 7% (although these are lower for the rarer mega-deals) – especially in Europe an d Asia. Interaction with investors is limited to the bookrunners, and the absence of pre-deal research also means that the contribution of other houses is effectively confined to settlement underwriting after pricing. A “pot system” ensures that non-bookrunner firms get paid a fixed portion of the fees based on the amount of stock they underwrite, while a “jump ball” arrangement enables them to chase sales credits (also called designations) from institutions after the event, to top up their takings.

The reality, however, remains that bookrunners dominate the ECM landscape. In recent times, distinction has been made between “active” joint bookrunners, those houses that are also appointed as joint global coordinators to manage the execution of a deal, and “passive” ones, who retain the title and are thus able generate orders, but come into the syndicate at a later stage in the process.

In Europe, and in Asia, things are somewhat different. While bookrunners similarly capture from 80% upwards of the fee pool, the possibility of writing research on a company in advance of bookbuilding (to support investor education) generally means a number of parasite firms finding their way into deals as joint lead managers or co-lead managers, normally on the basis of pre-agreed – and fixed – economics

. But because these houses can’t really get traction with investors, their role is becoming increasingly redundant. They have no control over the book of demand, and therefore allocations of stock – and the lower level of commissions in non-U.S. markets is making it more difficult to justify passive underwriting.

Enter the co-bookrunners. The idea is simple: to give these firms a different title to motivate them. This also enables issuers to secure the appointment of additional bulge-bracket houses – traditionally reluctant to take on junior roles – to help market their ECM deals. The catch is that deal databases such as Dealogic will not give any credit to co-bookrunners in league tables, although these houses will obviously not shy away from advertising their roles in pitches and marketing material. Examples are still few and far between, but they have started to figure in some landmark deals. For example, two co- bookrunners were appointed in the US$4.8 billion IPO of Petronas Chemicals Group Berhad in Malaysia in November 2010, alongside the three top-line joint global coordinators and joint bookrunners.

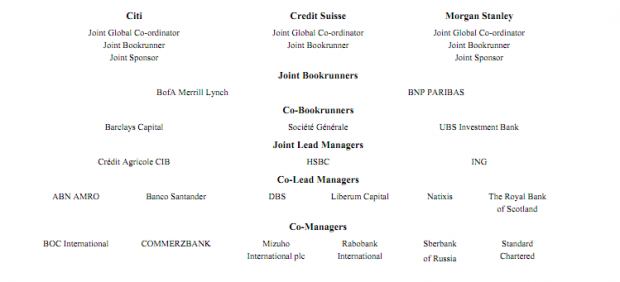

The US$10 billion IPO of Glencore International plc in Hong Kong and in London in May 2011 also included three co-bookrunners, in addition to five joint bookrunners (three of which were also joint global coordinators), as follows:

And now there’s even pressure on the bookrunners. In the June 2010 US$12 billion H share IPO of Agricult ural Bank of China Limited (itself part of larger, US$22.1 billion global offering) the company appointed – late in the process – four joint global coordinators out of the seven bookrunners. They were rewarded with higher fees and a global coordinator praecipium, based on their respective corporate finance execution work and efforts in securing a $5.45 billion tranche of cornerstone investors, in what has now become a business school case study of how issuers should manage the appointment of their underwriters.

At a time when smaller players – boutiques – are slicing away an increasingly large share of the global M&A pie, conversely there would appear to be trouble on the horizon for the more marginal ECM players.

(Philippe Espinasse worked as an investment banker in the U.S., Europe and Asia for more than 19 years and now writes and works as an independent consultant in Hong Kong. Visit his website at https://www.ipo-book.com. Readers should be aware that Philippe may own securities related to companies he writes about, may act as a consultant to companies he mentions and may know individuals cited in his articles. To comment on this column, please email [email protected]).

[This article was originally published on Dow Jones Investment Banker on 9 November 2011 and is reproduced with permission.]

Copyright (c) 2011, Dow Jones & Company, Inc.