Tag: Hong Kong

16 April 2011

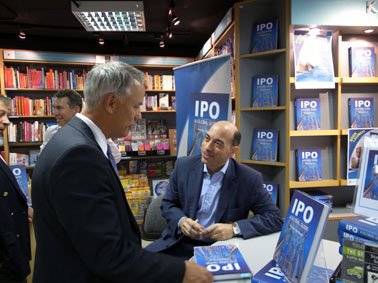

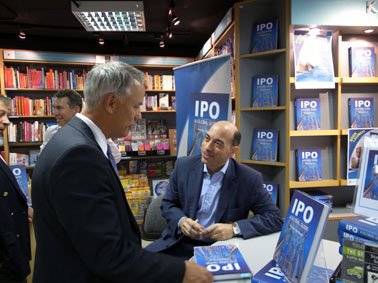

“IPO: A Global Guide” was formally launched on 15 April 2011 at Kelly & Walsh in Exchange Square in Hong Kong. The event was well attended, and saw the author signing a number of copies of the book. The attendees came from a variety of backgrounds and included, among others, ECM bankers, research analysts, traders, company directors, lawyers, investors, students and journalists.

read

Events, Hong Kong

Events, Hong Kong

14 April 2011

Glencore International plc filed today an announcement detailing the terms of its proposed US$9 billion to US$11 billion flotation on the LSE and the Stock Exchange of Hong Kong. The filing reveals a transaction mainly comprised of new shares to be issued, as well as the prominent role played in the deal by Morgan Stanley and Citi.

read

Hong Kong, Secondary listings, Switzerland, UK

Hong Kong, Secondary listings, Switzerland... +1 more

14 April 2011

HONG KONG (Dow Jones Investment Banker) – Another week, another beauty pageant for a multi billion- dollar IPO in Hong Kong. In local fashion, Guangdong Development Bank (GDB) is said to be meeting brokers next Sunday and Monday to select bookrunners for a capital raising of up to US$4 billion, with a dual listing in Shanghai and Hong Kong.

read

China, Hong Kong, Pitches

China, Hong Kong, Pitches

12 April 2011

HONG KONG (Dow Jones Investment Banker) – The US$1.44 billion IPO and listing in February on the London Stock Exchange of Justice Holdings Ltd. marks something of a revival for special purpose acquisition companies. It raises the question: Why are SPACs yet to make it big in Asia, which last year accounted for more than 54% by volume of IPOs globally? They could do well in Hong Kong in particular.

read

Hong Kong, Malaysia, Singapore, South Korea, SPACs, UK, US

Hong Kong, Malaysia, Singapore... +4 more

07 April 2011

HONG KONG (Dow Jones Investment Banker) – With the lure of diamonds and soaring multiples in the jewelry sector, the jockeying is now on to become a bookrunner for the IPO of Chow Tai Fook Jewellery Co. Ltd. The offering, in Hong Kong, is expected to raise some US$3 billion.

read

China, Hong Kong, Pitches, Yuan securities

China, Hong Kong, Pitches... +1 more

07 April 2011

HONG KONG (Dow Jones Investment Banker)- The report from Hong Kong’s Securities and Futures Commission (SFC) this week couldn’t have come at a more awkward time. Just as Singapore is mounting a challenge to Hong Kong’s dominance in Asian equity capital markets, the regulator has chastised brokers and banks for failing to meet standards as IPO sponsors. Hong Kong Exchanges and Clearing Ltd. (HKEx) thus finds itself in the spotlight at the same time it needs to defend its market share.

read

Due diligence, Hong Kong, Regulators, Singapore, Sponsors, UK, US

Due diligence, Hong Kong, Regulators... +4 more

05 April 2011

“IPO: A Global Guide” was featured on Bloomberg TV today in an interview I gave to anchor Susan Li in her “First Up” show at 07:40am Hong Kong time.

This is a high-profile segment which, since it takes place early in the morning, is being played out repeatedly throughout the day’s programming. read

Hong Kong, Interviews, Market conditions, REITs, Singapore

Hong Kong, Interviews, Market conditions... +2 more

04 April 2011

HONG KONG (Dow Jones Investment Banker) – Allocating distinct retail tranches within equity capital markets deals is a purely mechanical exercise that involves balloting by a share registrar and transfer agent. By contrast, assigning shares to institutional investors is more of an art than a science, and involves making subjective judgment calls. The recent US$2.5 billion equivalent placement by Ping An Insurance (Group) Company of China Ltd. shows how a seemingly simple transaction can leave a sour taste with investors, as well as the importance of structuring and allocating offerings in an even-handed manner.

read

Allocations, China, Hong Kong, Independent advisers

Allocations, China, Hong Kong... +1 more

30 March 2011

HONG KONG (Dow Jones Investment Banker) – Richard Li appears again to be following in his father’s footsteps. Hong Kong’s richest man, Li Ka-shing, just spun off the container port assets of Hutchison Whampoa Ltd. as a business trust on Singapore’s SGX in the world’s largest IPO so far this year. Now PCCW Ltd., in which the younger Li holds a 27.1% stake, is considering a similar listing in Hong Kong for its telecommunications arm, which accounts for about 90% of PCCW’s business.

read

Business trusts, Hong Kong, REITs, Singapore

Business trusts, Hong Kong, REITs... +1 more

30 March 2011

HONG KONG (Dow Jones Investment Banker) – Last weekend’s simulated trading exercise for yuan securities in Hong Kong, coordinated by the stock exchange, was always a clear signal that the long- awaited launch of the first real estate investment trust to be traded in China’s currency would soon follow. True to form, investor education may be about to kick off for the deal. What has emerged so far shows a few innovations in the offer structure, as well as potentially aggressive pricing.

read

China, Hong Kong, Property, REITs, Singapore, Yuan securities

China, Hong Kong, Property... +3 more