HONG KONG (Dow Jones Investment Banker) – As one of Asia’s richest nations, the Sultanate of Brunei Darussalam relies on a significant expatriate population for the production of offshore oil. That, in turn, has fuelled the growth of its major mobile telecommunications provider, Data Stream Technologies Communications (DST). But with penetration rates near saturation, DST needs to re-invent itself and offer value-added products and services besides roaming. With equity markets in turmoil, it could consider issuing an Islamic going-public convertible bond prior to a listing in Kuala Lumpur – or in Singapore, perhaps through a business trust.

A tiny Muslim nation in South East Asia, Brunei is the second-richest country in Asia in terms of GDP per capita after Singapore, ranking fifth globally in 2010 according to the IMF. Half of its GDP comes from oil, especially through offshore drilling. It’s also known for its sovereign wealth fund, the secretive Brunei Investment Agency (BIA), whose assets are said to be in the region of US$30 billion.

Brunei’s telecommunications industry is dominated by Telekom Brunei (TelBru) and DST. Both are unlisted companies. Telbru is the sole provider of fixed lines. Its subsidiary company, B-mobile, provides 3G mobile services, as does DST.

DST is Brunei’s only provider of GSM. The company also operates retail outlets for mobile devices, as well as nationwide two-way trunk radios for the oil industry and for air-freight and delivery companies. It also offers pay-television through Kristal-Astro, Brunei’s only operator of multi-channel satellite TV, which is a JV between DST and Malaysia’s Astro All Asia Networks PLC.

Financially, little is known about DST, which was created in 1995. It employs about 400 people, and has about 400,000 customers taking pre-paid and post-paid services for its 2G and 3G networks. Brunei has a mobile penetration of 105% and DST holds a 78% market share. Coverage enables roaming to more than 68 destinations and 126 network operators around the globe, including to destinations that operate non-GSM 900/1800 networks such as Japan, Korea, Mexico and the U.S. With a large expatriate population working in the oil and related industries, that’s where a significant part of DST’s value lies: a dominant market share allows it to apply high rates to subscribers.

In this respect, DST has a fairly similar profile to Bahrain Telecommunications Company B.S.C. (BATELCO), a US$1.5 billion listed company. Despite a mobile penetration rate of 138% in Bahrain – which could increase to 164% in 2012 according to Startup Arabia – BATELCO is a cash cow that currently pays a dividend yield of 11.4%.

Conversely, with a high mobile penetration in Brunei, most of the local population on pre-paid plans and increasing competition from VoIP services, DST needs to offer more value-added services to increase revenue per user, and may consider regional partnerships and alliances.

While market conditions could currently favor yield plays, DST may not yet be ready for a full-blown listing. It could, however, raise funds now through issuing a pre-IPO Islamic bond (or sukuk), to convert into equity at a premium upon listing. This would be similar to the US$3.5 billion instrument issued by DP World Ltd, (Dubai Ports) prior to its listings on Nasdaq Dubai and on the London Stock Exchange. Since Brunei itself has no stock exchange, DST could list on Bursa Malaysia, in Kuala Lumpur, the world’s leading market for Islamic finance products.

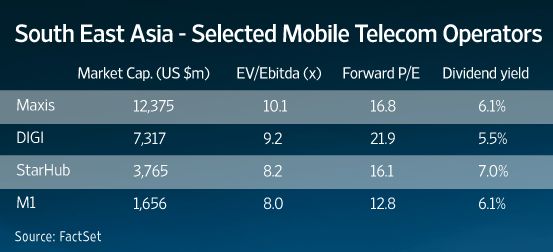

Given its small size, it’s unlikely that DST would reach the trading levels of 8x to 10x EV/Ebitda achieved by larger regional competitors. Depending on which businesses are ultimately included in the listed vehicle, it may however be able to post a higher yield and could even be listed through a business trust on Singapore’s SGX.

Such a move would be a minor revolution for the small nation state. His Majesty Paduka Seri Baginda Sultan Haji Hassanal Bolkiah Mu’izzaddin Waddaulah may (thankfully) rely on others to pick up the phone, but will he make the call?

(Philippe Espinasse worked as an investment banker in the U.S., Europe and Asia for more than 19 years and now writes and works as an independent consultant in Hong Kong. Visit his website at https://www.ipo-book.com. Readers should be aware that Philippe may own securities related to companies he writes about, may act as a consultant to companies he mentions and may know individuals cited in his articles. To comment on this column, please email [email protected]).

[This article was originally published on Dow Jones Investment Banker on 6 October 2011 and is reproduced with permission.]

Copyright (c) 2011, Dow Jones & Company, Inc.